Cash Book Definition, Types Accounting Format of Cash Book

One column is for the transactions related to the cash, and the other column is for the transactions related to the business’s bank account. So, under the double-column cash book, the business also records cash transactions and transactions through the bank. But on the other hand, the transactions on credit are not recorded while preparing the double column cash–book. This type of cash book is used by businesses who want to track each individual transaction in the most detail possible. Triple column cash books will show all of the details from single and double column cash books plus some additional details. These would include things like purchase discounts, cash sales information and more.

Balancing and posting a double column cash book

If, on the other hand, the credit column exceeds the debit column, the difference represents “overdrawn balance”. If the cheque is not deposited into a bank account on the same date, it is treated as cash and, therefore, the amount will appear in cash column. It is worth mentioning that the format of a three column cash book is similar to that of a two column cash book. It is crucial to ensure that all transactions are accurate and transparent while maintaining books of accounts. Tracking regular expenses regularly helps avoid overspending and manage budgets wisely.

Examples of Cash Book Entries

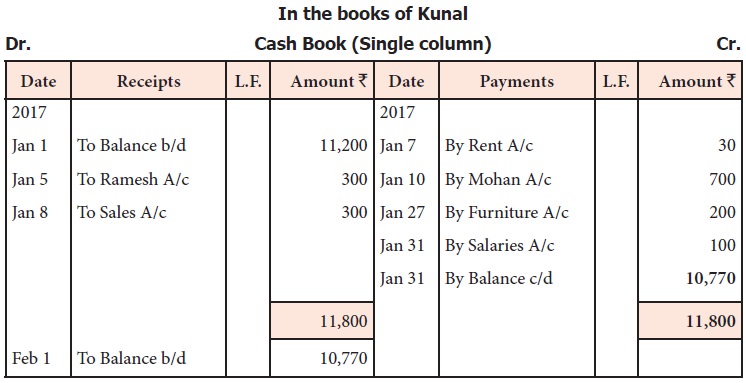

To make the two sides of the single column cash book equal, the difference is written on the credit side as “balance carried down” or simply “balance.” This column shows the cash balance at the start of the current period. After recording the opening balance in the description column, the cash transactions of the current period are recorded.

Cash Book and Bank Statement

11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Finally, in the usual manner, the receipt of cash is recorded in the cash column. Let us understand the advantages and disadvantages of cash book accounting through the points below.

The difference between both of the cash books is that the columns of ‘Particulars’ and ‘Date’ are the same for the receipt and payment sides. The bank cash book is a type of cash book that is used to track the transactions between a business and its bank. All of this information is very important what is the difference between notes payable and accounts payable for accounting and tax records. It is essential for businesses to keep track of their finances in order to stay compliant with the law. A detailed cash book has its own unique way of recording transactions. Keep reading to learn which type would make the most sense for you or your business.

Income Statement

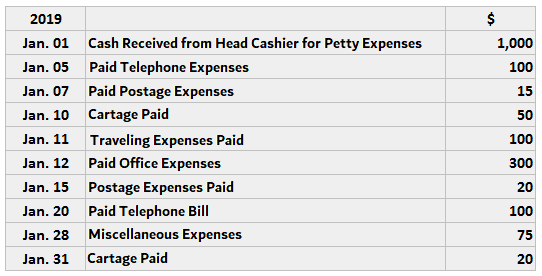

A two-column cash book is prepared when both cash and bank transactions happen in the business. We have developed a petty cash log for a business that uses petty cash. It is helpful if you are using petty cash and accounting software, as you can post the totals to the correct expenditure codes. The balance of cash in a cash book is the total amount of money that is currently in the account. This includes both the money that has been deposited and the money that has been withdrawn. The cash flows will change with every transaction that is recorded in the petty cash book.

All computerized bookkeeping programs use a cash book but youmight not see the words Cash Book, you might just see something like BankEntries, or Spend and Receive Money or Transactions. Angela is certified in Xero, QuickBooks, and FreeAgent accounting software. To simplify bookkeeping, she created lots of easy-to-use Excel bookkeeping templates. Below is an example of a paper-based cash book using a standard A4 lined pad. Jami Gong is a Chartered Professional Account and Financial System Consultant.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. A contra entry is when an entry is made on the debit side and the same entry is recorded on the credit side of the cash book. To differentiate contra entries from other entries, letter “C” is printed in the posting reference column (on both the debit and credit sides of the cash book). If an entry is made on the debit side and the same entry is recorded on the credit side of the cash book, it is called a contra entry. If a payment is made by cheque, it will be recorded on the credit side in the bank column. If you are ever recording entries in a three column cash book, this section presents a few key points you should bear in mind.

- If you run a small charity or record personal cash transactions, it is likely to use a single-column cash book.

- However, for the payment of small expenditures (e.g., stationery, travel, postage, and newspapers), paying by check is unreasonable.

- The single-column cash book resembles a t-shaped cash account in almost all respects.

The contra entry is made only when the cash is withdrawn for business use. If cash is withdrawn for personal use, it will be recorded only in the bank column on the credit side of the cash book. A Cash Book is an Original Entry (or Prime Entry) book in which all cash and bank transactions are documented chronologically. When the business is small, it is easy to record every transaction in a single book called a ‘Journal’. But gradually when the business expands, it becomes inconvenient to record such a large number of transactions in a single book.

We will explore various types of cash books, such as single-column, double-column, single-entry, and double entry. Additionally, we will discuss the benefits of using an accounting package for your cash book management and introduce our Free cash book template. When David deposits money with the bank, he makes an entry on the debit side of his cash book. Additionally, the bank records all deposits received from David in the credit column of his statement of account. Record the transactions shown below in a single column cash book and post to the ledger. The following points should be kept in mind when posting the single column cash book to the relevant accounts in the ledger.

The most popular formats are the two and three column formats as detailed below. The cash book is updated from original accounting source documents, and is therefore a book of prime entry and as such, can be classified as a special journal. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.